Mamluk Halal Investment

A Shariah-Compliant Passive Real Estate Investment Product

⭐️⭐️⭐️⭐️⭐️

Traditional vs. Shariah Investment Model

Traditional Real Estate Funds

- Loan Based

- Fund charges 8-12% interest rate to the Operator

- Returns to investors average 5-8%

MHI Shariah Compliant Real Estate Fund

- Investment based

- Returns to investors are 12-15%

- Profit-Share model

- Fund takes security in the property to hedge risk

Investment Strategy

Market Identification

To seek out commercial property joint ventures in and around the cities of Newark and Jersey City, NJ which can be zoned for a large-scale real estate development. In most cases, the owners of the properties are not fully aware of the actual zoning value of the properties.

Monetize Asset

With approvals in place, the value of the asset will increase. The asset will then be sold to a large regional/ national developer at a premium.

In the event the approvals are not granted, the property can be liquidated at the “as of right” approval.

Improve Asset

Utilize longstanding partnerships with professionals who have local market knowledge and expertise to acquire necessary approvals to make the asset “shovel-ready” (such as zoning approvals, architecture plans, traffic studies, feasibility studies, etc.)

Property Acquisition

Acquiring properties or entering into joint ventures with commercial property owners that meet the criteria for redevelopment.

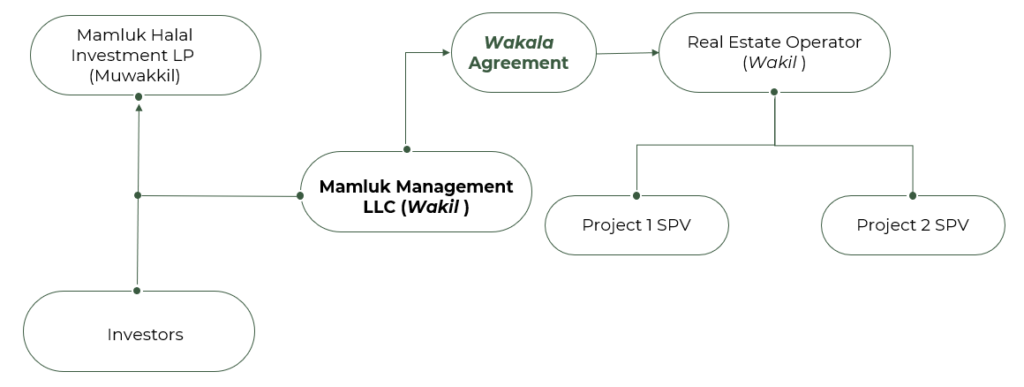

Investment Structure

All: ▲ 33.3%

Term

The investment strategy will be to hold properties short-term (roughly 300 days per property)

There will be an investor lock-in period of 15 months whereby proceeds from one property will be rolled over into the next deal to compound returns

At the end of the third year, the investment vehicle will dissolve and return all principal and profits to investors

Average

12-15% per annum

Projected Returns

In a Shariah-compliant structure, returns cannot be guaranteed as they are tied to actual profits, which are purely speculative

Given the investment strategy, the investment vehicle is projected to return approximately 12%-15% per annum on investment

Investment Structure

The investment will be offered as a private placement under Rule 506(c) of Regulation D

The investment will be available to only accredited investors under Rule 501, which includes:

Individuals with a net worth of $1 million (excluding primary residence)

Individuals with an income of $200,000 or household income of $300,000

Minimum investment amount will be $50,000

Investment Structure

Sample Deal Process

MHI Fund Deploys $2M Investment into Property

After Approval, Property Yields $400K return to MHI Fund

Fund expenses are deducted

Mamluk Management (20%)

Investors (80%)

Key Individuals

Mamluk Management LLC

Tariq Hussain, Esq.

Shahroz S. Ahmad, Esq.

Griffin Partners

Phillip Seligmann